ZKsync Tokenomics Revamp: Utility vs. Revenue

Alright, let's talk about ZKsync. Specifically, this sudden pivot towards making their ZK token, you know, useful. After months of languishing, we're seeing a surge in price and a lot of buzz about "revenue-focused tokenomics." But is this a genuine turnaround, or just clever marketing designed to pump the price? As someone who’s spent more time than I’d like to admit staring at crypto charts, my gut says it’s time for a deep dive.

The Vitalik Bump and the Tokenomics Shift

First, the setup: ZKsync got a nice little boost from an endorsement by Vitalik Buterin himself. The ZK token jumped over 50% after Buterin supported a ZKsync post. A tweet can move markets, folks (especially in crypto), but a tweet is not a business model. And let's be honest, that initial surge was likely fueled by speculation and hype.

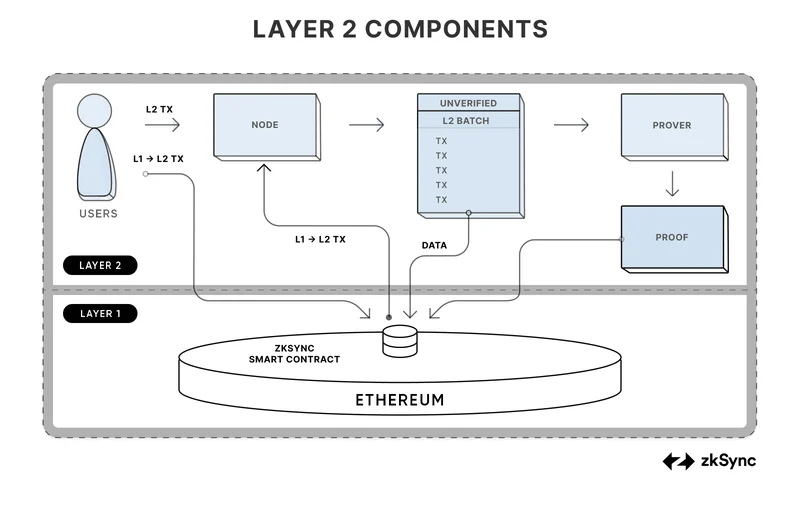

The real story is the proposed tokenomics shift. ZKsync wants to transform ZK from a pure governance token (which, let's face it, is often code for "worthless unless you're really into voting on obscure protocol changes") into a utility token. The idea is to tie the token to actual revenue streams from on-chain interoperability fees and off-chain enterprise licensing. This revenue would then fund staking rewards, ecosystem development, and a buyback-and-burn mechanism. Sounds great on paper.

The market reacted positively. ZK jumped 14% on the day of the announcement and is up 62% on the week. Now, here's where my skepticism kicks in. The article notes that "forward knowledge of the proposal may have been frontrun." Translation: insiders likely knew this was coming and bought up ZK beforehand, hence the unusually large price jump before the official announcement. (It's not illegal, per se, but it certainly smells fishy). This isn’t an uncommon occurrence in the space.

Digging Into the Details (or Lack Thereof)

The proposal is still vague. As one article points out, major questions remain. Fee sizes? Buyback schedules? Emission management? All TBD. This is "Part One" of the plan, which means we're essentially looking at a PowerPoint presentation with a lot of aspirational language but very few concrete details. Gluchowski, the CEO of Matter Labs, talks about creating a "self-reinforcing economic loop." It’s a nice phrase, but what does it actually mean in terms of hard numbers and verifiable metrics?

And this is the part I find genuinely puzzling. The article mentions that enterprises using ZKsync’s tech for "complex uses such as treasury integrations" should return value to the ecosystem via licensing agreements. But ZKsync's stack is open-source. So, they're essentially saying, "Hey, you can use our stuff for free, but if you make a lot of money with it, you should probably pay us something." It's a bit like asking people to voluntarily donate to a public radio station. Some will, most won't. What kind of revenue can they realistically expect from this? It's hard to quantify, but I'd wager it's significantly less than they're projecting.

I've looked at hundreds of these filings, and this particular revenue model is unusual. Typically, open-source projects rely on support contracts or premium features to generate revenue. This "voluntary licensing" model seems… optimistic.

The Big Question: Can They Deliver?

The success of this pivot hinges on execution. Can ZKsync actually generate meaningful revenue from interoperability fees and enterprise licensing? And more importantly, can they effectively use that revenue to support the ZK token and the broader ecosystem? The devil, as always, is in the details.

We’re talking about a token that is down 54% over the past year, and down 83% from its all-time high. That’s a long way to climb back, and a lot of disillusioned investors to win back. The market cap is currently around $380 million. To make a real difference, they'll need to generate tens of millions of dollars in recurring revenue. Is that feasible? Maybe. But it requires a level of execution and adoption that ZKsync hasn't demonstrated yet.

Smoke and Mirrors?

Look, I'm not saying ZKsync's tokenomics shift is doomed to fail. But I am saying that investors should approach this with a healthy dose of skepticism. This could be a genuine effort to create a more sustainable and valuable ecosystem. Or it could be a desperate attempt to pump the price of a struggling token. Only time—and, more importantly, hard data—will tell.

So, What's the Real Story?

The math doesn't lie: show me the actual revenue, and then we'll talk.

Tags: ZKsync

nvidia: What? – It's a Complete Mess

Next PostSolar's Getting Too Big: What's the Catch?

Related Articles