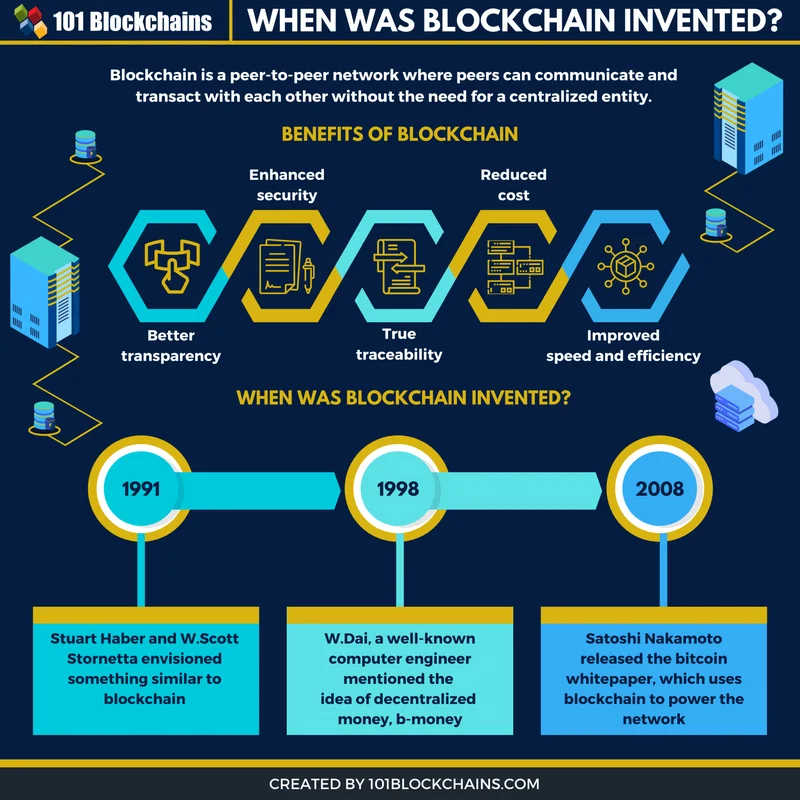

Blockchain: What It Is and the Latest News

Generated Title: Agentic AI and Blockchain: The Unsexy Revolution PayPal Missed

The Coming Payments Paradigm Shift

PayPal, the erstwhile king of online payments, faces a reckoning. For two decades, it’s been my default, and likely yours. Safe, easy, fast – the trifecta. But the game’s changing. The convergence of agentic AI and blockchain isn't just an incremental upgrade; it's a fundamental shift in how value moves online. According to Boston Consulting Group (BCG), global payments revenue is projected to hit $2.4 trillion by 2029, driven by agentic AI, digital currencies, and real-time payments. That’s the headline. The real story is buried in the fine print: control is shifting from centralized intermediaries to individual users.

Three companies – Bankr, Olas Pearl, and the TON chat wallet ecosystem – offer a glimpse into this future. They aren’t just processing transactions; they're building autonomous systems that act on our behalf.

Bankr, for example, is a conversational, onchain AI agent accessible on X and Telegram. It turns your social handle into a wallet login and executes transactions directly from chat. The founder of Bankr, Deployer, claims that "AI agents will provide more financial opportunities to more people because they handle the complex part for you… analyzing the market and teaching people how to trade all through simple conversation." It's a compelling vision: financial services embedded in the existing social fabric.

The implications here are significant. If Bankr can truly abstract away the complexities of crypto (and that's a big "if," given the inherent security risks), it could onboard a new wave of users who wouldn’t touch a decentralized wallet with a ten-foot pole. Danielle Brown-Wolf, Head of Growth at Bankr, calls this “the PayPal moment for crypto.” The analogy is apt, but perhaps understated. PayPal simplified payments; Bankr aims to make them invisible. The question is: Can it scale without sacrificing security or transparency? And will users trust an AI agent with their funds?

Olas Pearl takes a different approach, offering an AI agent marketplace where users can build and deploy autonomous agents to manage everything from invoice matching to subscription updates. David Minarsch, the co-founder of Valory AG, envisions a future where "every individual can deploy their own on-chain AI agent… one that manages money, data, and decisions transparently." Think of it as an app store for financial robots.

Pearl's decentralized structure is particularly noteworthy. By running agents on a decentralized network, it avoids the single point of failure inherent in centralized platforms. Every action is recorded on-chain, creating a transparent and verifiable history. The potential applications are vast, from DeFi trading agents to automated bill payment systems. A DeFi trading agent named Modius, produced a strong return in just a few months. But this raises a crucial question: How do you ensure the agents are programmed ethically and don't exploit vulnerabilities in the system?

Chat-Native Commerce

The TON wallet ecosystem inside Telegram represents yet another frontier: chat-native commerce. Wallets live within the messaging app, allowing users to send and receive payments without ever leaving the conversation. It's a seamless experience, blurring the line between communication and commerce.

Goodies, a Telegram mini app built on TON, exemplifies this trend. It blends collectibles, brands, and payments in a single platform. Sticker packs from Kung Fu Panda, Pudgy Penguins, and Lamborghini sell out in seconds. Luca Netz, the CEO of Pengu, describes the strategy as “Embedding brand Intellectural Property (IP) into daily habitual (GM) and conversational moments through memes and GIFs… with tokenization of stickers on Telegram, there’s a new layer of ownership and expression unfolding.”

Danny Wheeler, Key Advisor at the Goodies Marketplace, stated that “our goal is to build the world’s first chat native economy. Every brand sticker, every collectible on TON, is proof that digital commerce can be instant, emotional, and transparent.”

The success of Goodies underscores the power of community and culture in driving adoption. It's not just about the technology; it's about creating a shared experience. The question is, can this model be replicated across other messaging platforms? And can it evolve beyond collectibles to encompass more complex financial transactions?

PayPal, to its credit, isn’t standing still. It’s experimenting with stablecoins (PYUSD), AI-driven fraud detection, and blockchain infrastructure. But these efforts feel reactive, not proactive. They’re playing catch-up in a game they helped define. The launch of PayPal USD (PYUSD) was significant, marking one of the first times a major payments provider issued its own fully backed stablecoin. What I saw at their Developer Days was also an impressive vision of where AI Agents are heading.

The Pattern, Not the Player

The key takeaway isn't any single company, but the underlying pattern: meeting users where they already are, turning plain language into secure actions, and preserving ownership and transparency. Bankr, Pearl, and TON each embody this pattern in different ways. The Next PayPal? How AI And Blockchain Are Rewriting Digital Payments

Cards and banks will still exist, but more payments will start and finish inside conversations, managed by agents people can trust and verify. That’s the part that feels like the next PayPal. Not a new button on a checkout page, but a new way the internet moves money. The real revolution isn't about speed or efficiency; it's about control. It's about empowering individuals to manage their finances on their own terms.

The Centralized Fortress is Cracking

The future of payments isn’t about incremental improvements to existing systems. It’s about dismantling the centralized fortress that PayPal and its ilk have built. Agentic AI and blockchain are the wrecking balls. The numbers don't lie; the power is shifting.

Tags: blockchain

Shell: Gas, Stations, and What's Near You

Next PostCloud AI's Observability Breakthrough: What We Know – What Reddit is Saying

Related Articles